Electronic tax invoice requirements:

- Edward Mburu

- May 28, 2022

- 1 min read

The following Guidelines provide the broad basis for VAT registered taxpayers to comply with the electronic tax invoice requirements: -

In compliance with the requirements of the Electronic Tax invoice, all VAT registered taxpayers should use a compliant tax register with the following functionalities: a) Check the invoice details (tax rate, taxable value, total tax and total gross amount) before issuance of the tax invoice to the customer.

b) Transmission of the validated tax invoices to KRA over the internet on a real time or near real time basis.

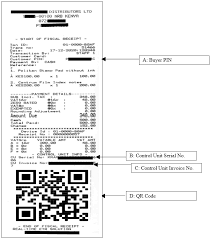

The key features of a valid Electronic Tax Invoice include:

a) Buyer PIN - refers to the PIN of the purchaser. The capture of the buyer’s PIN is optional when generating an invoice and is only applicable where the purchaser intends to claim input tax for the VAT paid.

Comments